Business Intelligence and Analytics solutions support the spectrum of self-service needs but requires good governance.

Many organisation that have invested in self-service analytics have become inundated by a tsunami of conflicting reports, spreadmarts, renegade reporting systems and other data silos. According to Forrester’s Business Technographics® Global Data and Analytics Survey, the “irony of self service is that it requires standardisation so as to not introduce far greater risk into the business.”

Banking client’s "Support Unit Group Data Office" Review

Cornerstone was recently asked to review a major Bank’s use of self-service BI & Analytics capability and solution as they were concerned about potential security and control issues within Finance, Audit and Risk Departments.

Our findings unearthed major issues including misaligned use cases, data access issues and ownership, limited best practice design resulting in performance challenges, inefficient training methods and no real community or advancement through sharing of ideas, assets, and upskilling.

This is not an uncommon issue with the growth of BI & Analytics capabilities in recent years but requires focus and experience to overcome.

What we did:

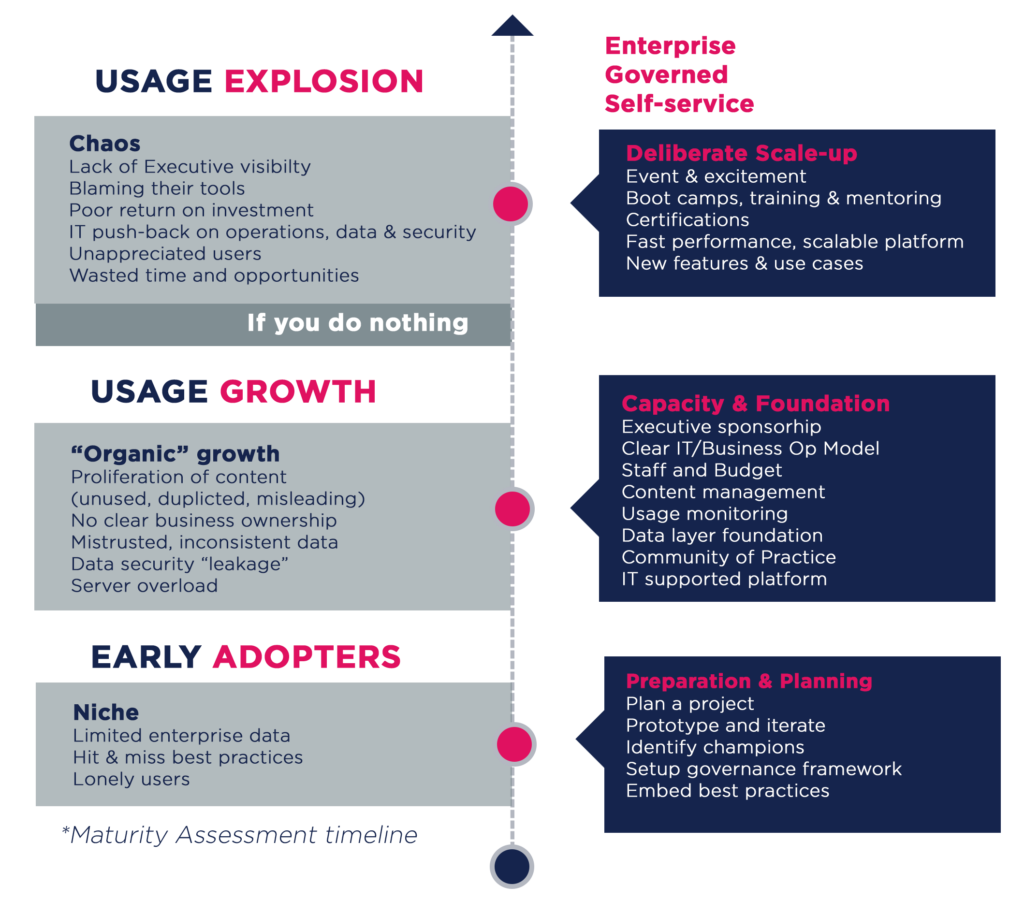

Cornerstone undertook a maturity assessment workshop to evaluate the banks current position. The assessment looked at target versus leading practice, with a report on gaps and a tailored roadmap plan.

From this assessment we were asked to lead an engagement to assist the Bank to deliver on the roadmap to reach Enterprise Governed Self Service.

The areas where we assisted were:

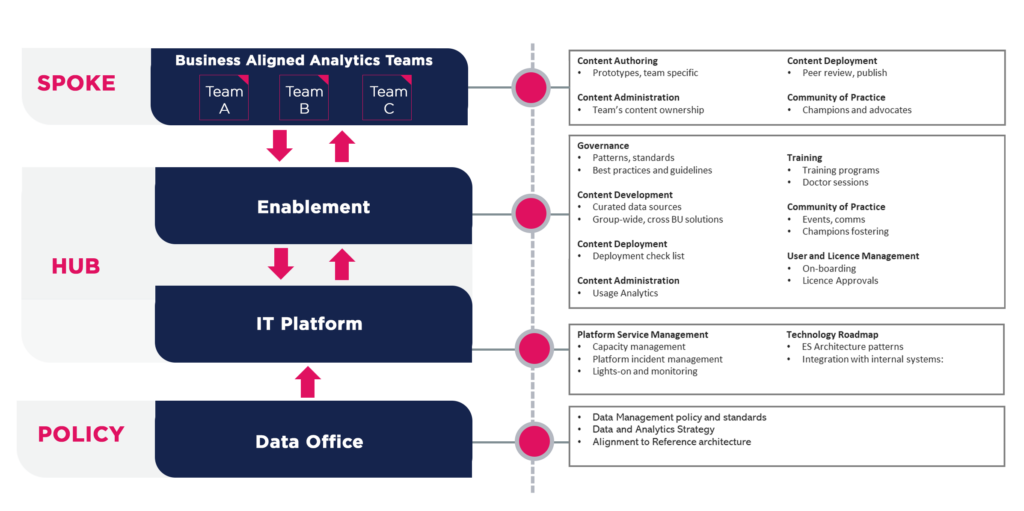

BI Operating Model Redesign – We designed a new operating model based on our Hub and Spoke solution. The Spoke represented specialised resources whose aim is to standardise current processes across a specific domain to meet their BU specific reporting and analytics requirements. The Hub included a BI & Analytics Hub and a Centre of Enablement (CoEn).

BI & Analytics Hub – Comprehensive knowledge of Metrics, Reports, Dashboards & Analytics in use across the domains and actively focuses on the “Information Supply” processes for BI & Analytics. This included data sourcing, analytics delivery, and Data Quality remediation.

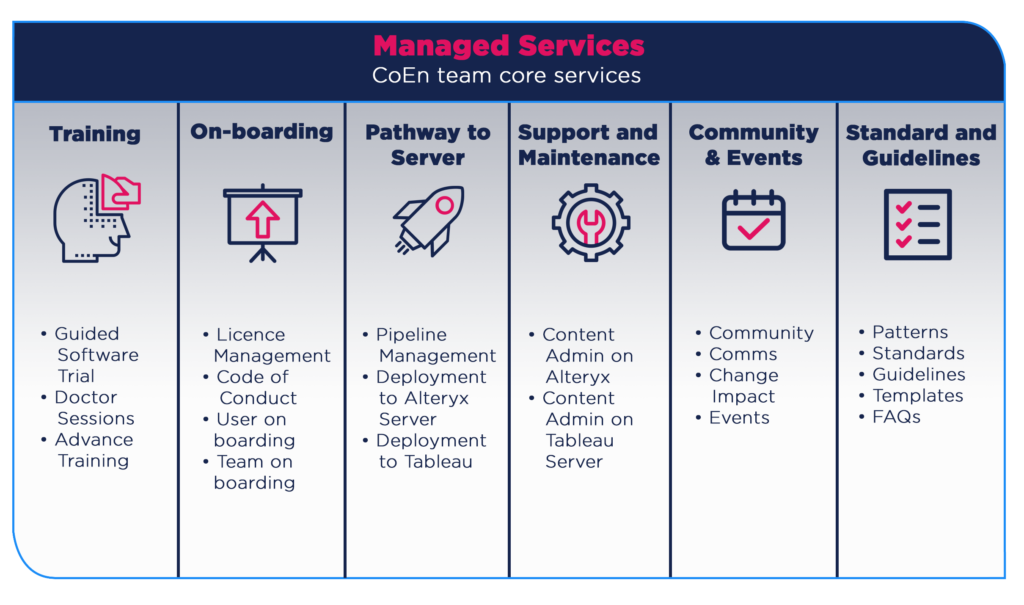

Set Up BI Centre of Enablement – Responsible for ensuring that selected BI & Analytics platforms operate under a governed set of policies, standards, and processes. This also covered user enablement via training and best practice guidelines, with content managed to drive standards and re-use within their core solutions e.g. Tableau, Alteryx.

Data Office – Fully integrated to ensure data governance and security best practices are applied. This also assisted the Data Stewards in the formulation of data governance and security policy aligned to the group standards (and later enabled through Data Governance tooling).

CoEn Framework – Our framework is an encompassing multi-level framework that paved the way for standardised and governed BI & Analytics which could be sustained and embedded within the bank:

Benefits – This resulted in a BI & Analytics function that could deliver various analytics initiatives for the Bank’s stakeholders. This was achieved, without over reliance on IT / Central analytics functions, but fully supported and accredited by the Data Office and IT guardrails. Also ensuring adherence to architecture patterns and a data governance framework that is now further underpinned by the Collibra toolset.

This reduced the costs of analytics delivery in many cases by half and decreased deployment timescales substantially due to design and data management standardisation and has resulted in a far more integrated team, delivering value for the bank in a sustainable way.

Download the case study

Download the case study here

Talk to us about your financial planning & analytics challenges