Price Volume Mix analysis in TM1

I was just reading through Price Volume Mix analysis IBM Accelerator template and it would have been be so useful for me about 5 years back when I had to create our own template for a pharmaceutical model. Here’s some of my ramblings about it.

What is Price Volume Mix?

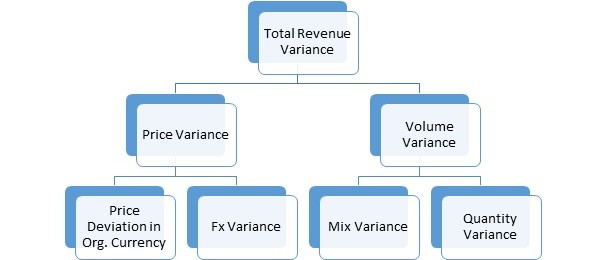

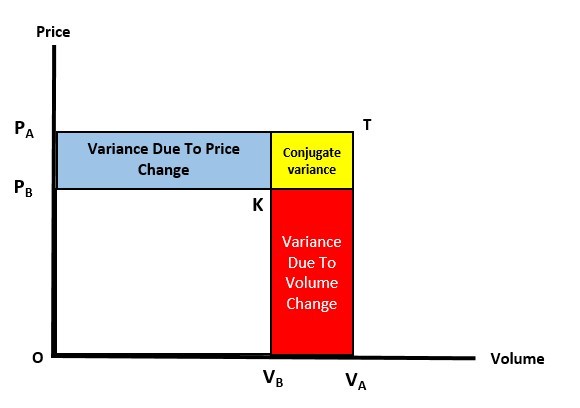

Price volume variance is a standard analysis for so called ‘widget’ companies (selling products as opposed to services), you’d see it often in FMCG, pharma, consumer product companies. It’s goal is to break down the sales variance between different scenarios and attribute the difference to:

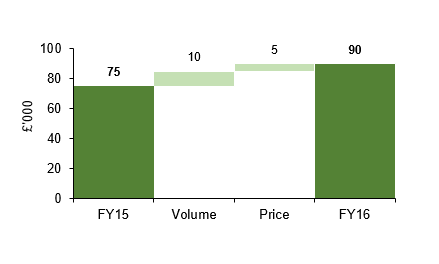

Visually you’d want to build a ‘bridge’ between 2 scenarios attributing the variance, like this:

that shows that the difference between FY15 and FY16 of 15k is split 10 / 5 between volume and price, so we’re getting 10k more cause we’re selling more and 5k more cause we’re charging more. Or like this if you’re into multiple axises charts:

Considerations for implementation

The IBM template includes so many important things from the get go:

There’s a few other ‘talking points’ I’d add:

By Yuri Kudryavcev, Principal Consultant, Cornerstone Performance Management

This blog was originally posted on Applied Dimensionality https://www.ykud.com/blog/cognos/tm1-cognos/pvm/

Follow us on LinkedIn to stay up to date.